HANDS ON BANKING

CASE STUDY: Hands on Banking

Susan Unger was hired by the Wells Fargo Foundation to author the Adult, Young Adult, and Teen curriculum, teacher’s guides, resource materials and promotional advertising for Hands on Banking, an award-winning financial literacy education program that has educated hundreds of thousands of individuals and families nationwide.

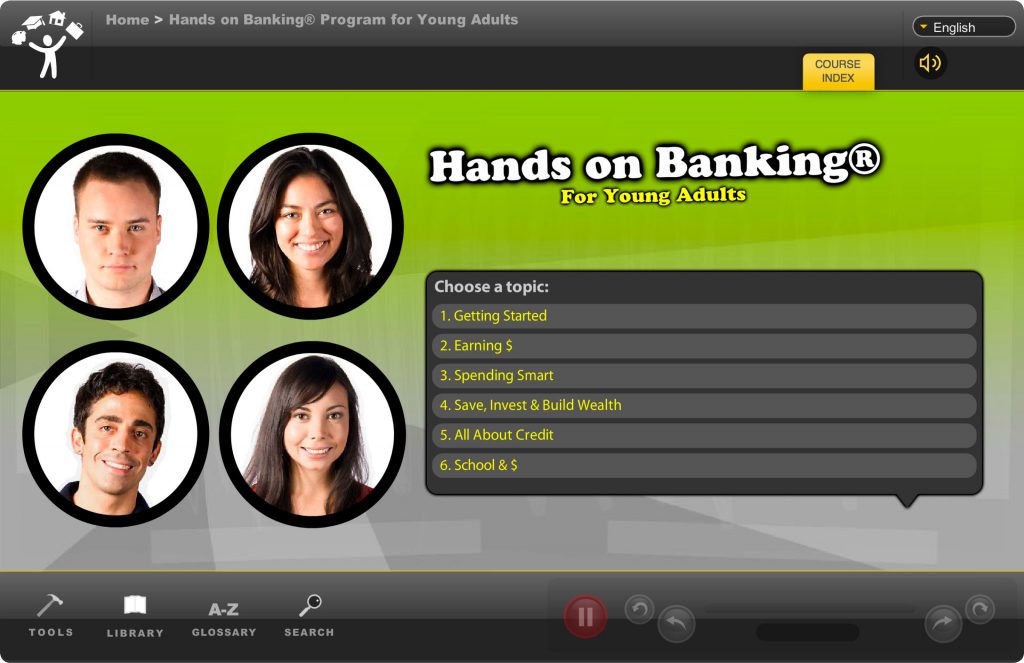

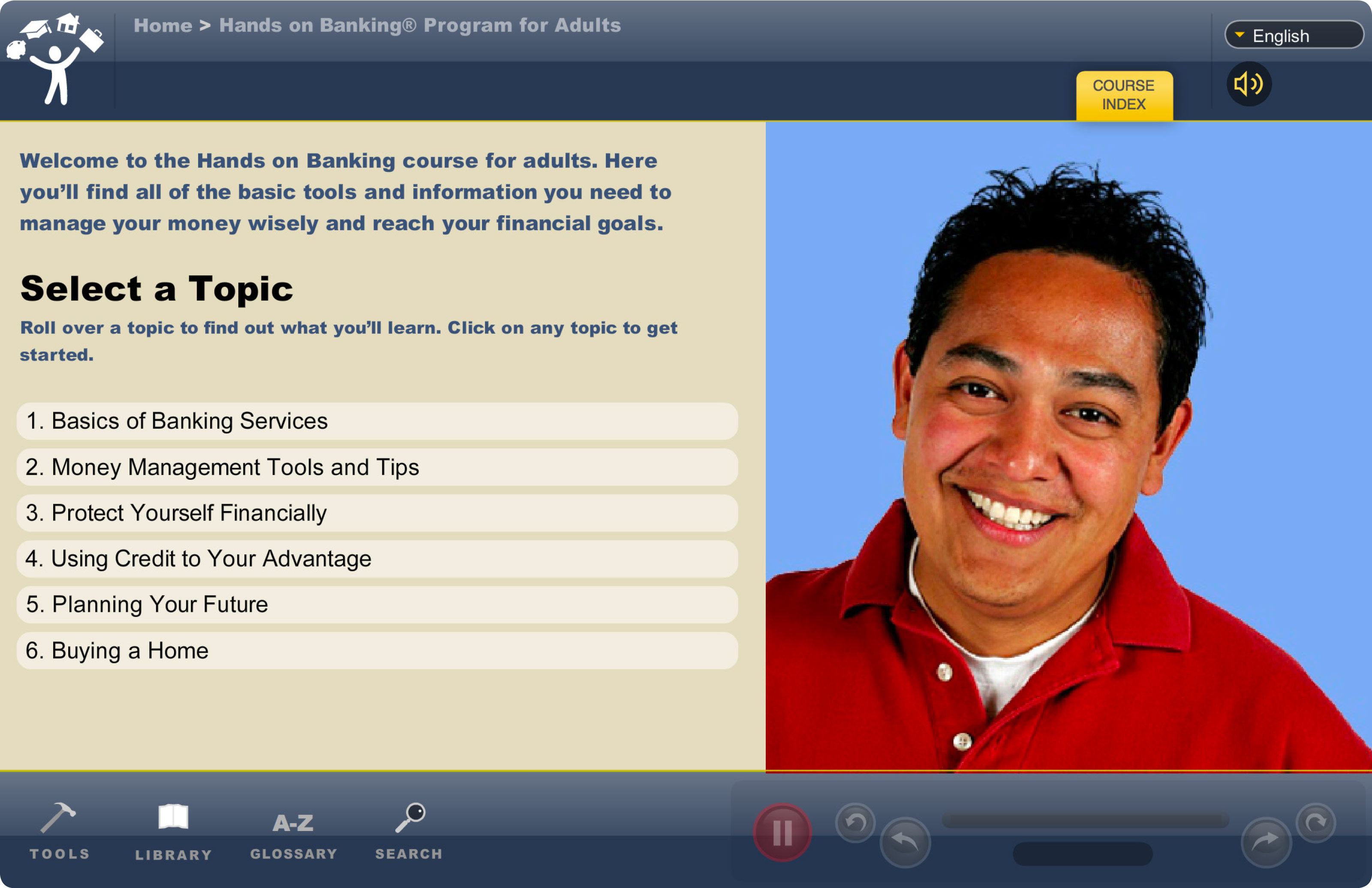

Hands on Banking teaches people in all stages of life the basics of responsible money management: how to create a budget, save and invest, borrow responsibly, buy a home, establish a small business, manage college loans, and more. The program encourages learning by addressing real-world money management questions in a format that’s animated, colorful, and fun. The Hands on Banking lessons, and the Spanish-language version, El futuro en tus manos, are ideal for self-study or classroom use.

Susan successfully researched, conceptualized, organized, and authored this comprehensive curriculum. She utilized easy-to-understand concepts and vocabulary, making the lessons accessible to people of all education levels, including those new to money management and/or to the U.S. banking system.

CASE STUDY: Hands on Banking

Since its inception, the award-winning Hands on Banking program has educated hundreds of thousands of individuals and families nationwide – teaching people in all stages of life the basics of responsible money management: how to create a budget, save and invest, borrow responsibly, buy a home, and establish a small business.

Hands on Banking encourages learning by addressing real-world money management questions in a format that’s animated, colorful, and fun. The Hands on Banking lessons, and the Spanish-language version, El futuro en tus manos, are ideal for self-study or classroom use.

Susan Unger was hired by the Wells Fargo Foundation to author the curriculum, teacher’s guides, resource materials and promotional advertising for Hands on Banking.

Susan successfully researched, conceptualized, organized, and authored all of the content needed for this comprehensive curriculum. She utilized easy-to-understand concepts and vocabulary, making the lessons accessible to people of all education levels, including those new to money management and/or to the U.S. banking system.